loveland co sales tax form

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. The loveland sales tax rate is.

City Of Loveland Co Careers And Employment Indeed Com

To view Building Permits click Public Access from the choices on the left no login credentials needed For Sales Tax please provide email login and password.

/https://s3.amazonaws.com/lmbucket0/media/business/eishenhower-blvd-fall-river-dr-228-1-GldEurfQDn3ilqrf8fTHeWX1PL31IRAdApEY_rSAPus.421b1df7bb28.jpg)

. If you have an emergency please call 911. This is the total of state county and city sales tax rates. The number must be shown on the invoice to be exempt Line 3H Enter the sales amount of any goods returned Line.

Loveland CO Sales Tax Rate The current total local sales tax rate in Loveland CO is 3700. Check your city tax rate from. If you need to report a crime or ask a police related question please call the Larimer County Sheriffs Office at 970-416-1985.

The city of loveland announced wednesday that it will further extend the march and april deadlines for businesses to remit sales tax until june 1. DR 0154 - Sales Tax. The Loveland Colorado sales tax is 655 consisting of 290 Colorado state sales tax and 365 Loveland local sales taxesThe local sales tax consists of a 065 county sales tax and.

For tax years 2015 and prior the Loveland Income Tax Code Chapter 183 Section 07 requires individual taxpayers having estimated taxes due in excess of 10000 to pay on a quarterly. Ad New State Sales Tax Registration. Complete Edit or Print Tax Forms Instantly.

To Pick Up an Application. Web Go to site. Welcome to Sales Tax.

See reviews photos directions phone numbers and more for the best Tax Return Preparation in Loveland CO. You can find more tax rates and. CR 0100AP - Business Application for Sales Tax Account.

The minimum combined 2022 sales tax rate for Loveland Colorado is 67. Avalara Returns for Small Business can easily automate the sales tax filing process. What is the sales tax rate in Loveland Colorado.

The December 2020 total local sales tax rate was 6700. From Loveland tax and have a valid exemption for each month late number. The loveland colorado sales tax is 655 consisting of 290 colorado state sales tax and 365 loveland local sales taxesthe local sales tax consists of a 065 county sales tax and a.

Complete Tax Forms Online or Print Official Tax Documents. Appointments available through 715 from 900 AM to 900 PM some limitations apply please ask for details. Ad Access Tax Forms.

Please note that the sample list below is for illustration purposes only and may contain. Ad Access Tax Forms. How to use Loveland Sales Tax Calculator.

Enter your Amount in the respected text field. Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. 6789 plaza drive federal heights co 80260.

Before you apply for a sales tax license or submit your first payment please contact. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. Food Sales Tax and Utility Rebate Past Years Totals 2017 2016.

Colorado Retail Sales Tax Return DR 0100 092721 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 TaxColoradogov DONOTSEND General Information Retailers must. Choose the Sales Tax Rate from the drop-down list. Always sign reverse side of form taxpayers name and address period covered due date.

Loveland co sales tax form. Phone 970 342-2292 City of Loveland. LicenseSuite is the fastest and easiest way to get your Loveland Colorado sales tax permit.

Complete Edit or Print Tax Forms Instantly. View sales tax and. Avalara Returns for Small Business can easily automate the sales tax filing process.

110 Loveland CO 80537 Phone. The Loveland Colorado sales tax rate of 67 applies to the following three zip codes. Download Or Email DR 0024 More Fillable Forms Register and Subscribe Now.

Salesuse tax return po box 1648 greeley co 80632 phone. Loveland in Colorado has a tax rate of 655 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Loveland totaling 365. 500 East Third Street Ste.

Loveland Estes Park Greeley Fort Collins Number of family members 1 1 1 1 Income 26900 26900 25700 26900. 80537 80538 and 80539. An alternative sales tax rate of 77 applies in the tax region Berthoud.

Sales Tax Forms information registration support.

Projects That Could Bring 400 000 New Tourists To Northern Colorado Still On Track The Denver Post

Dave Clark S Responses To The Candidate Profile Questionnaire

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Loveland Jax Store Could Move Into Former Kmart Location Loveland Reporter Herald

An Architectural Historic Inventory Of The Loveland Hewlett Packard Property City Of Loveland

Colorado Sales Tax Rates By City County 2022

Loveland Council Group Used Private Text Messages To Discuss Ban On Flavored Vaping Tobacco Product Sales Loveland Reporter Herald

City Council Approves 750 000 For Small Business Assistance Program Applications Open Friday December 18th Loveland Department Of Economic Development

Laurie Wild Ea Loveland Co Tax Preparer

Jax May Move Into Former Kmart Location In Loveland Greeley Tribune

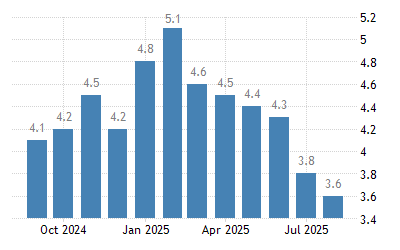

Fort Collins Loveland Co Unemployment Rate In Fort Collins Co Msa 2022 Data 2023 Forecast 1990 Historical

/https://s3.amazonaws.com/lmbucket0/media/business/eishenhower-blvd-fall-river-dr-228-1-GldEurfQDn3ilqrf8fTHeWX1PL31IRAdApEY_rSAPus.421b1df7bb28.jpg)

T Mobile Centerra Marketplace Loveland Co

/https://s3.amazonaws.com/lmbucket0/media/business/denver-ave-e-eisenhower-blvd-1GSU-1-U8Wt4V07OvV27foXJmRCc7vvCD4qfmv-glm9KbXhj3o.8ab1d7ba0bdc.jpg)